The sovereign bond market is now in the center of the attention of investors around the world. The change in central bank policy along with the lack of rising inflation and the escalation of the conflict between the US and China seem to be strengthening the bull market in the debt market.

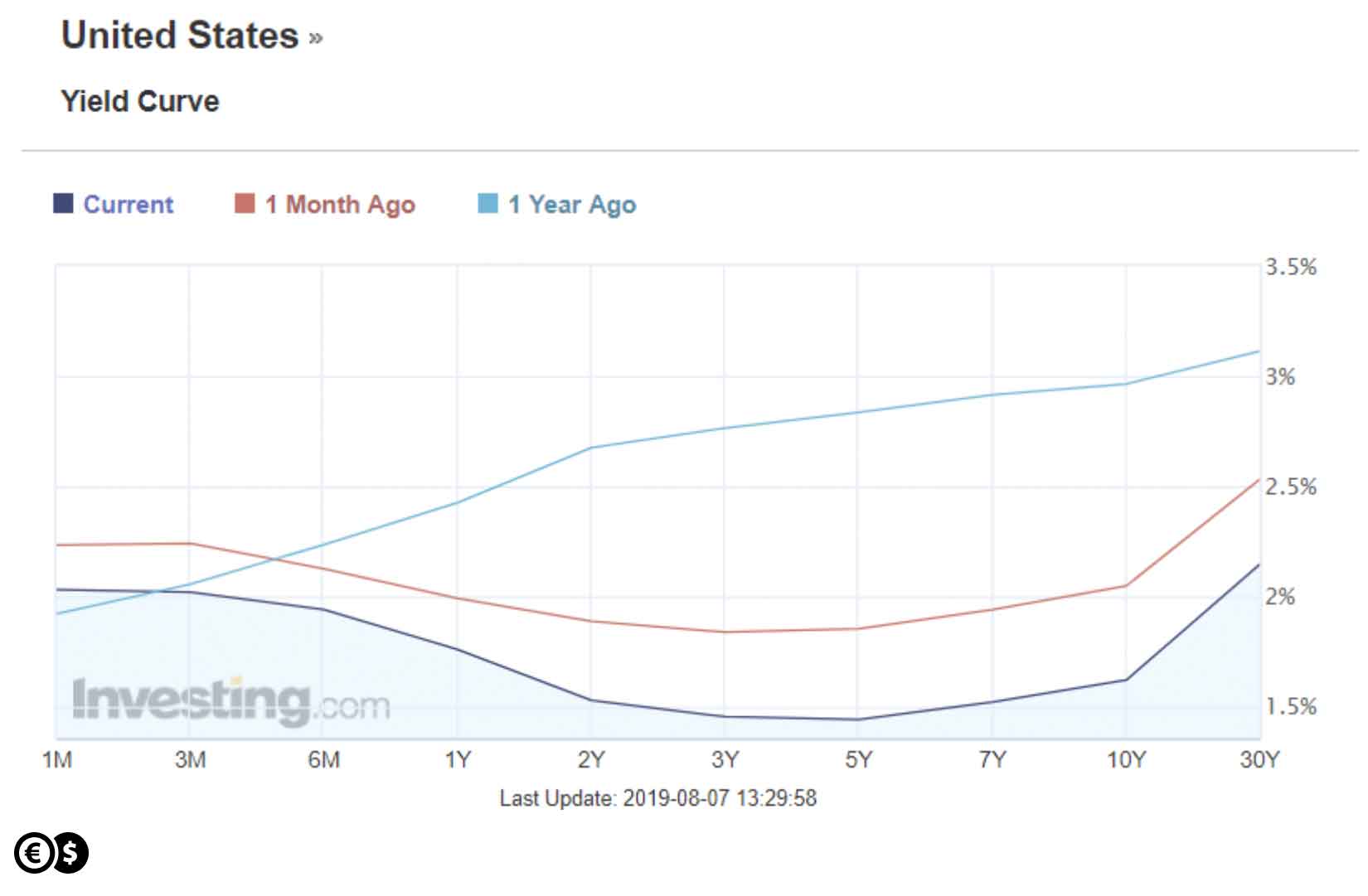

Yields on 30-year US bonds fell to their lowest level ever. The yield on 10-year US bonds was the lowest in three years, and 2-year bonds fell below 1.6 percent. As a consequence of the more strongly falling yields at the longer end, there is an increasing inversion of the yield curve.

Increasing yield curve inversion. Source: investing.com

In practice, this may mean that the market is very worried about economic slowdown or recession and is also counting on further easing of monetary policy.

We observe demand for bonds not only in the US but also globally. In Australia, the yield on 10-year bonds fell to 0.955 percent, the lowest in history. Meanwhile, the interest rate on 10-year German bonds reaches almost -0.6 percent, which is also a level never seen before. All this seems to confirm that the market is seriously considering global monetary easing due to uncertainty about the future economic situation caused by the trade war.

With such a bull market in the debt market, we may observe a definite slump in the stock market. However, there is no lasting decline in share prices, because the economy is doing very well at the moment. Moreover, expectations for help from central banks mean that investors in the stock market do not assume the worst scenario. Therefore, it seems that corporate profits and their outlook are still key for global stock exchanges. If the situation worsened here then it could actually translate into the stock market.

Weekly chart of S&P 500. Conotoxia trading platform

It seems that we have been dealing with a disinflationary slowdown in the economy for a long time, which seems to be beneficial for the bond market. Theoretically, after this phase of the cycle should come a phase of disinflationary recovery, which in turn may be beneficial for the stock market. Perhaps by then stock prices might fall and it could be more attractive.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.