Trends on the currency market can last much longer than usually passed. Hence, often during the given trend we can observe comments about its change and reversal. It was no different with the downward trend of the EUR/USD pair, which has been going on since the beginning of February 2018.

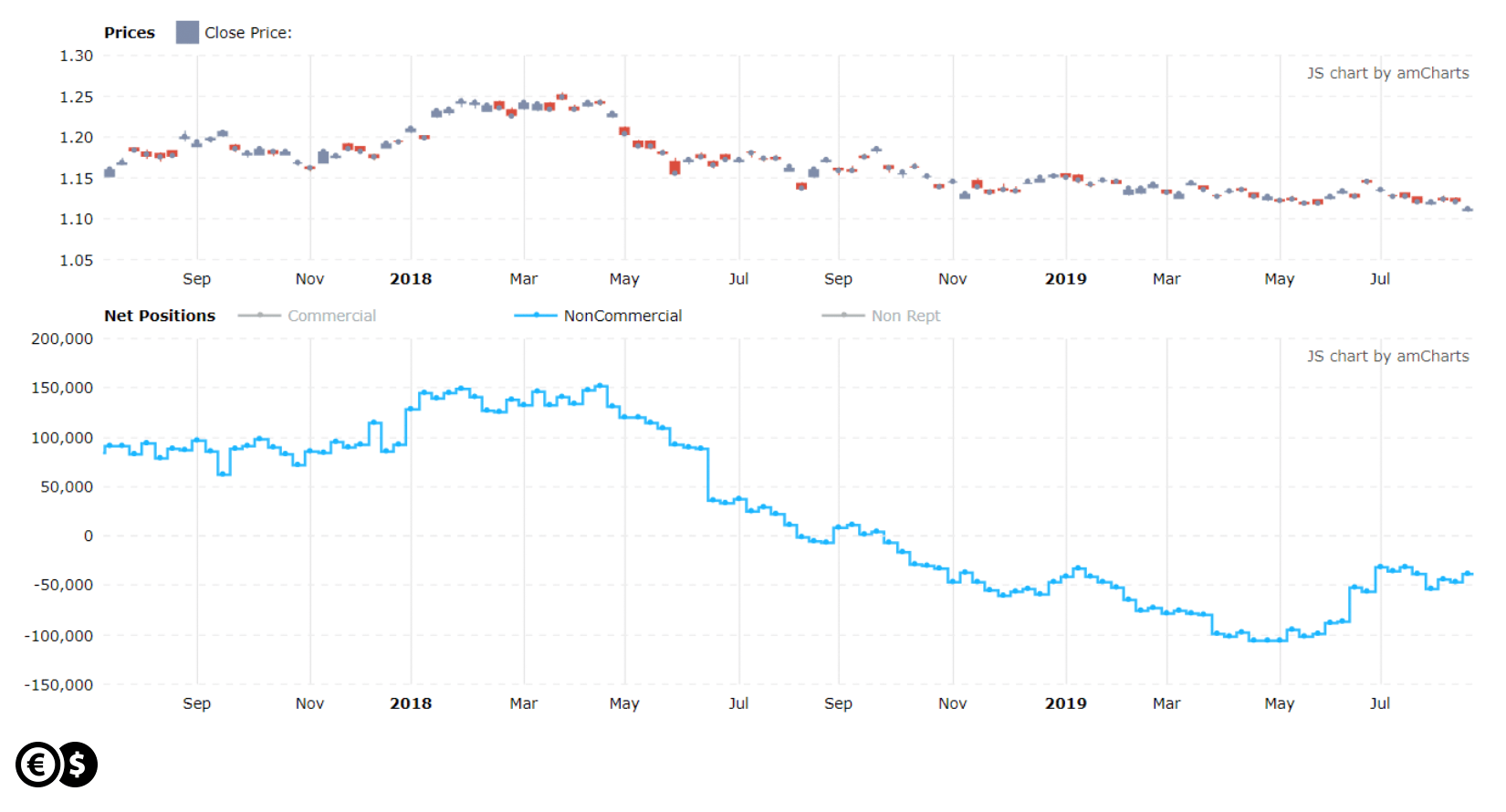

A year and a half ago, the euro cost above $ 1.25. Currently, the rate is oscillating at 1,11, and therefore close to the lowest levels from spring 2017. From a fundamental analysis point of view, the situation in the euro area deteriorated much faster and much more than in the United States, which could have had a negative impact on the euro against the US dollar. The indicator of negative economic surprises for the euro area is currently much higher than for the US. This means that most of the published data from Europe is not only weak, it is still below market expectations.

This situation may cause that the surveyed economists, whose opinions are used to create a market consensus, will start looking at subsequent macroeconomic data releases even more pessimistically. If that happened, even weak data from the real economy could still be better than market consensus. Because market expectations are the most important for investors, even a lack of visible improvement in macro data could change sentiment.

What's more, institutional investors have started to reduce their involvement in short positions on the futures market since May. Net long positions illustrating the difference between long and short positions were reduced from May to August from -105,000 contracts up to -37,000.

Non-commercial net long positions and EUR/USD. Source: tradingster.com

The divergence between net positions and the exchange rate historically indicated the possibility of changing the long-term trend. Of course, history may or may not repeat itself, but it is worth paying attention to the current situation in this market.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.