Oil prices seem to be a barometer of market sentiment when it comes to concerns about global economic growth. Concerns, in turn, can grow with the escalation of the trade conflict between the United States and China.

Today in the afternoon, WTI crude is down almost 3 percent, which means a drop to the level observed last time in March this year. WTI oil fell below USD 58 because worries about the global economy were overshadowed by the forecast of a fall in US oil stockpiles. The escalation of the trade conflict that the Chinese media are writing about is about relying on the possibility of restricting rare earth exports to the US. Of course, China would also lose out on this movement, but the United States would suffer more severely.

As a result, investors seem to be turning to safe assets, such as government bonds, and divest themselves of risky assets, such as shares. On the other hand, oil may depreciate because the slowdown in the global economy may also mean a drop in demand for crude oil. On the other hand, the drop in demand may affect the fall in prices, which is what we are observing.

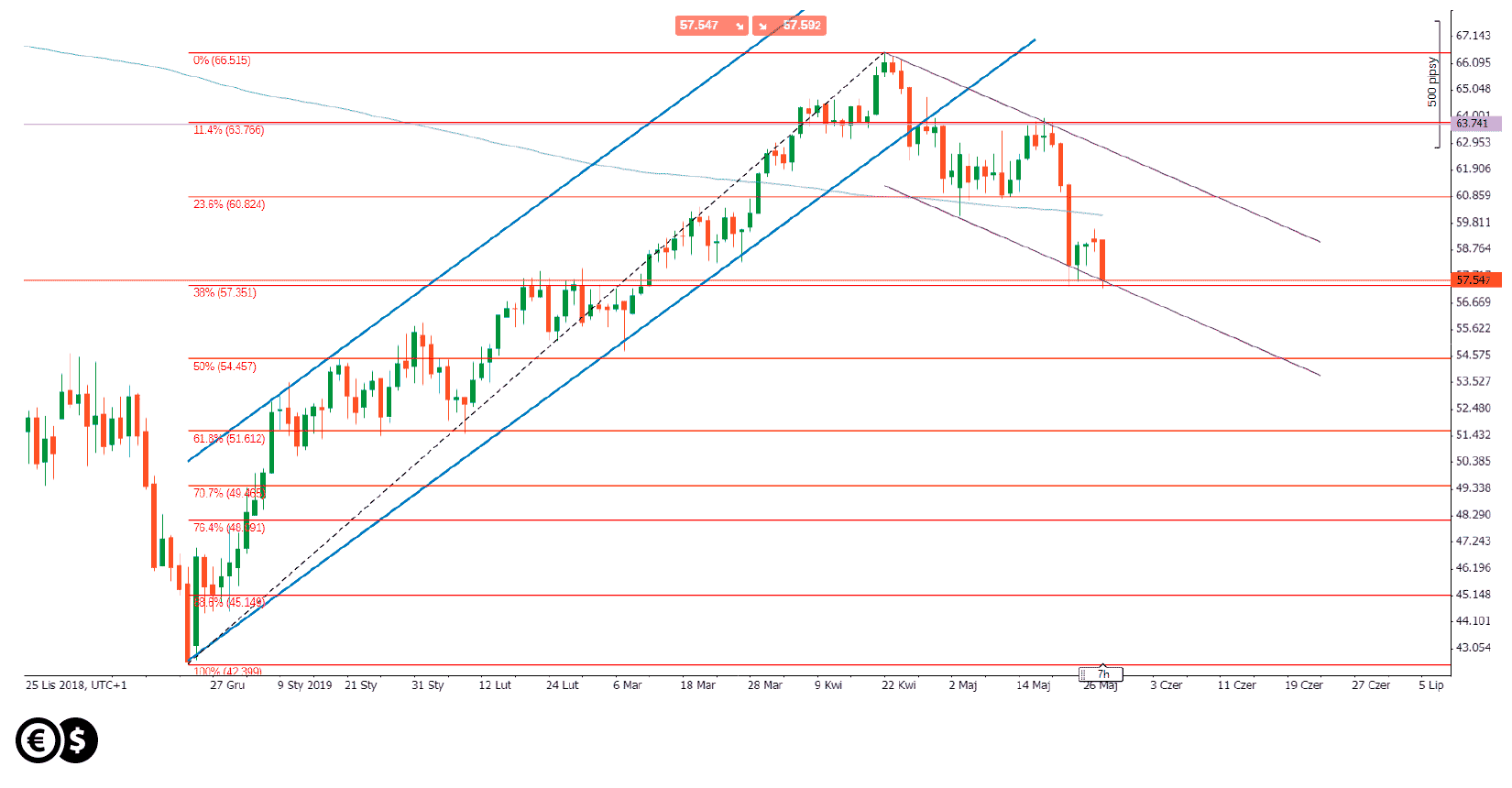

Chart: Oil WTI, D1. Conotoxia trading platform.

Lookin on the chart of crude oil we can spot a downward trend channel. Its lower limit with the Fibonacci retracement is the first important support level. The next one might be located at the 50 percent of previous upward movement.

Meanwhile, demand factors for the oil market might be a possible increase in tensions in the Middle East or further efforts of OPEC and OPEC + countries to reduce oil production. The current cuts are expiring in June and chances are that the production policy will be set at the meeting at the beginning of July.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.