The Mexican peso is experiencing a real rollercoaster recently. One of the most popular currency pair for the possible use of the carry trade, i.e. buying a higher interest-bearing currency, is torn-up by information about the trade war that the US President Donald Trump wanted to open with a new front.

At the end of May, the US president announced that if Mexico did not stop the flow of illegal immigrants to the United States, from June 10, it would impose a 5-percent tariffs on all Mexican products. Then, with each subsequent first day of the month, the tariffs were to be raised by 5 percentage points, up to 25 percent in October. At that time, the USD/MXN rate reacted sharply.

Today we are observing a completely different situation, where the peso strengthened, and the market has abandoned safe havens such as the Japanese yen and the Swiss franc, which seem to be depreciating at the beginning of the week. In addition, the head of the Bank of Japan, Haruhiko Kuroda, said today that the Bank of Japan may provide larger monetary stimulus if necessary. Returning to the statements of Donald Trump, the US president announced that he would not impose a gradual scale of tariffs on goods from Mexico after Mexico agreed to adopt a stricter stance on immigration. Of course, the issue of agreement with China has not yet been resolved.

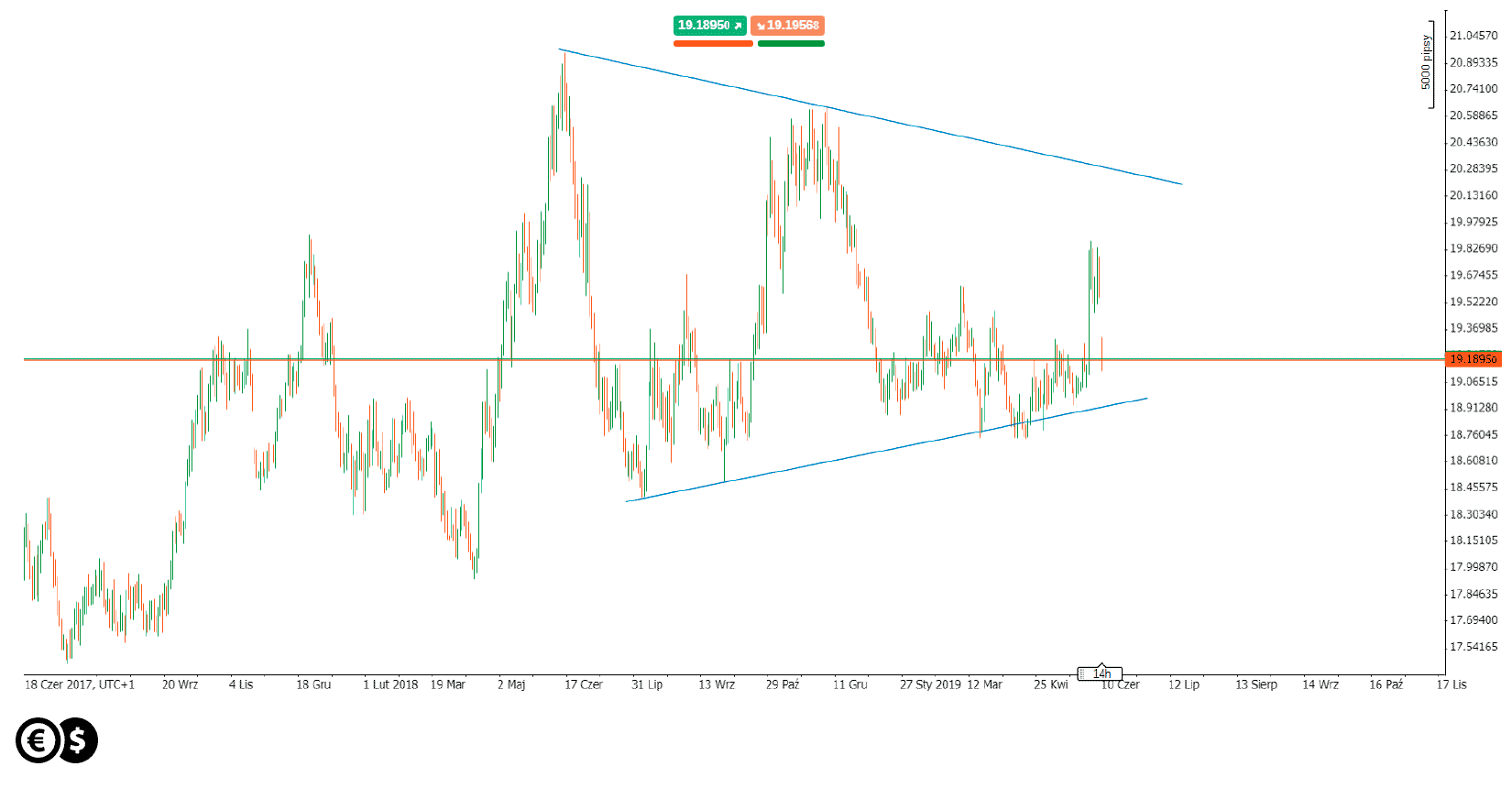

Chart: USD/MXN, D1. Conotoxia trading platform

The suspension of tariffs could also have influenced the odds of interest rate cuts in the United States, which have declined slightly after this statement. It seems to affect US bonds, which were slightly cheaper, and also for the dollar, which strengthened today in the morning.

Today, at 10:30 a.m., British GDP and industrial production will be published. In addition to macroeconomic data, investors' attention may be focused on political issues. Boris Johnson, the front-runner to succeed Theresa May as United Kingdom Prime Minister strengthened his rhetoric about Brexit and presented a plan for tax cuts. The game for the prime minister's position has already begun.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.