One of the most interesting events in the macroeconomic calendar may be the meeting and decision of the Reserve Bank of Australia. On Tuesday, June 4 at 6:30 we will find out whether the RBA cut the cash rate to another record low of 1.25 percent.

Changes in interest rates in Australia over the years resemble a ride on a roller coaster where steep and high uphill slopes start a very fast decline. In 2008, the cash rate in Australia was at 7.25 percent. Due to the financial crisis of the previous decade, the RBA was forced to cut the cost of money to the level of 3 percent. Then, in the hopes of a post-crisis recovery in the economy, interest rates were raised to 4.75 percent in 2011. Since then, we have been observing its systematic cutting. The current level of 1.5 percent is maintained from August 2016, but this may change next week.

There is basically unanimity on the market that at the meeting on June 4, the RBA may decide to cut cash rate by 25 basis points to the level of 1.25 percent. This conviction increased further after the words of the central bank's governor. Philip Lowe said that a lower interest rate would support employment growth and would speed up the period in which inflation is consistent with the goal. Given this assessment, we will consider the issue of lower interest rates at the next meeting. What's more, the central bank may not stop there. The market is speculating about another cut so that at the end of the year the interest rate might be at 1 percent.

Decrease in inflation to the lowest level since the third quarter of 2016 (1.3 percent) due to lower gasoline and real estate prices and increase in the unemployment rate to the highest level since August last year seems to be in favor of cutting interest rates.

These events may have an impact on the Australian dollar, which has been under pressure for a long time. Due to the potential of interest rate cuts and the escalation of the trade war, there are also revisions of forecasts regarding the AUD/USD. Even if yesterday, ANZ bank lowered its forecast from 0.70 to 0.65.

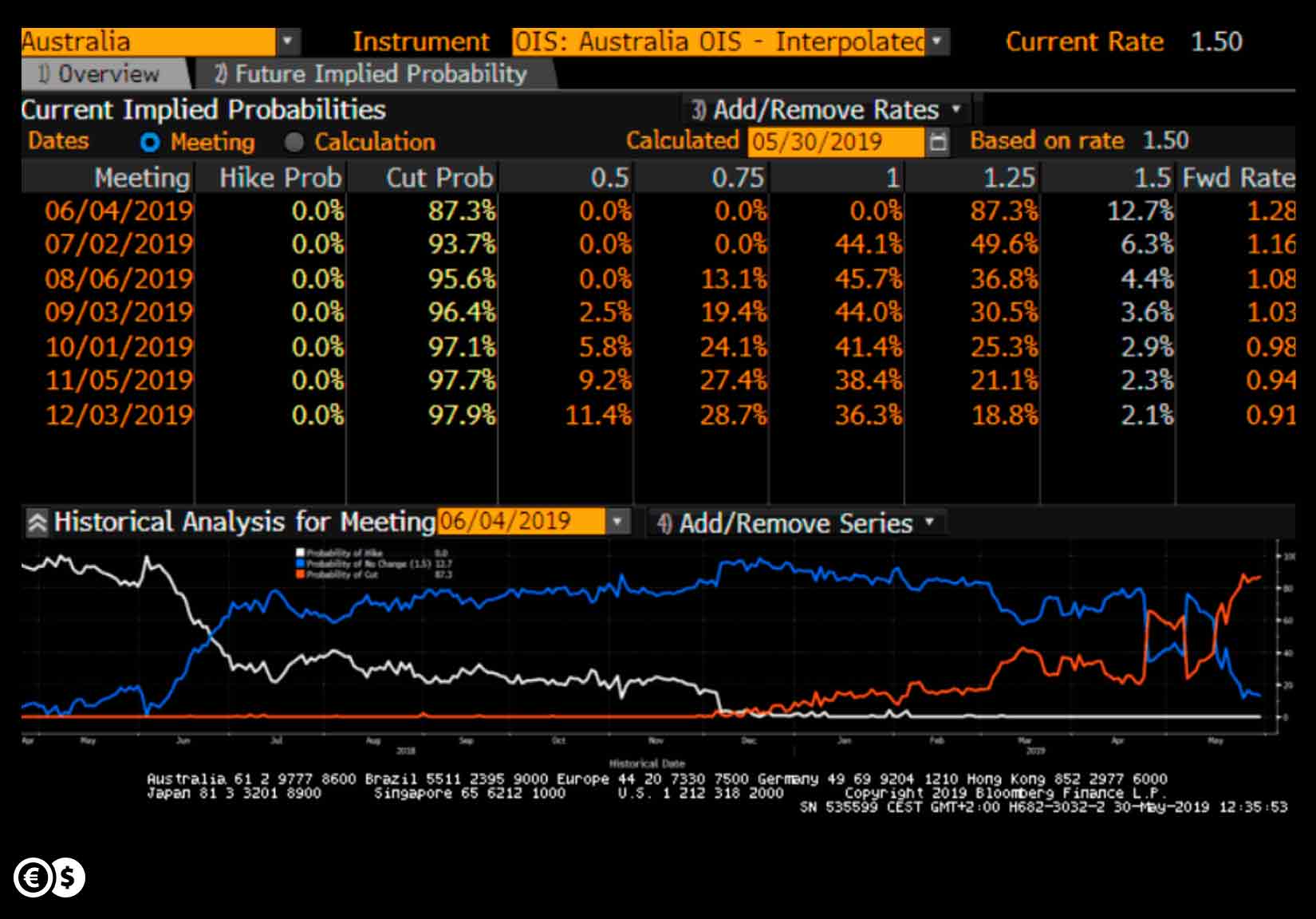

Market implied probabilities of interest rate cut in Australia. Source: Bloomberg

Interest rate market participants estimate that the cut of interest rates by 25 basis points may take place with 87 percent probability. This probability has increased sharply in May.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.