One of the most interesting events of this morning was the decision of the Reserve Bank of Australia (RBA) on interest rates. In line with market expectations, the central bank decided to cut the cash rate from 1.25 percent to a record low of 1 percent.

For the first time since 2012, the RBA decided to cut interest rates from the meeting to the meeting, as the previous cut took place at the beginning of June. Such a high determination of the central bank is aimed at supporting employment growth and ensuring greater certainty that inflation will be consistent with the medium-term goal. The RBA stated that it will continue to monitor developments in the labor market and adjust monetary policy if it is necessary to support sustained economic growth and achieve the inflation target.

The RBA "wait and see" policy – first waiting for macroeconomic data and then possibly acting on interest rates – means that the chances of a possible next cut in interest rates are rather small. The Governor of the Reserve Bank of Australia, not so long ago, mentioned that the effect of interest rate cuts and the impact on the economy are not as strong as they used to be. Therefore, the Australian dollar strengthened even though interest rates were cut. It seems that we may have a longer break from the RBA's activity now, and all attention will be paid to the US Federal Reserve, which may cut interest rates at the end of July, which could weaken the US dollar.

In addition, AUD prices can also be supported by the rising price of iron for which Australia is an exporter of. Price of this mineral have climbed to levels recently observed in 2014. In turn, from the beginning of this year, the futures contract for iron ore has risen by over 40 percent. This is one of the arguments for the Australian dollar.

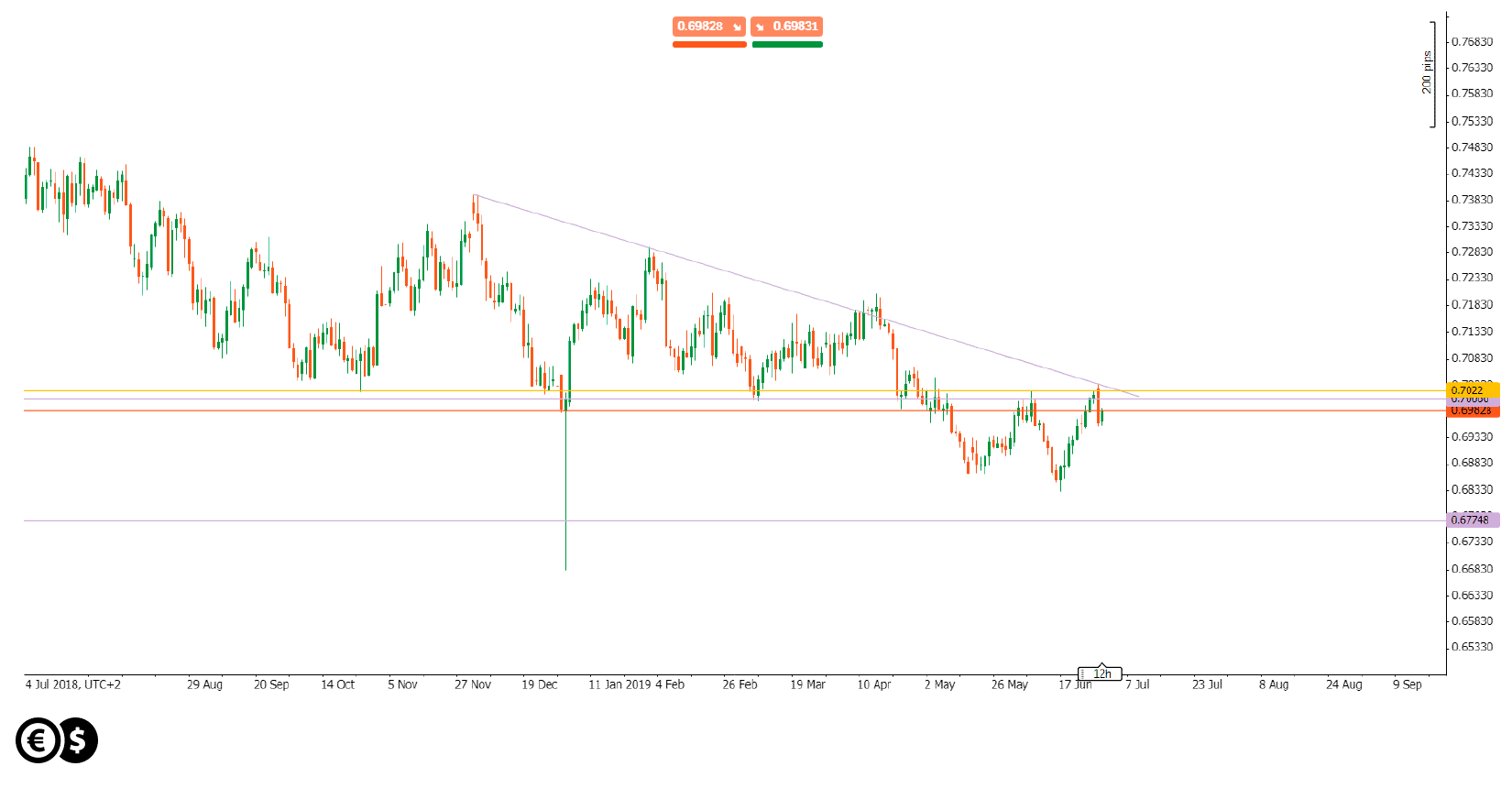

AUD/USD, D1 chart. Conotoxia trading platform

AUD/USD rise has stopped in the resistance area, which results from the round level of 0.7000 - which previously was a support. The trend line is also an important barrier for the buyers. It seems that only crossing these barriers would open the way to higher levels.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.